The Ontario Real Estate Association (OREA) published a report in which they highlighted that around 40% of parents are assisting their children financially when purchasing a home. It was surveyed that 4 in 10 parents helped their children with ages ranging from 18 to 38in the purchase of a property. Out of these, 44% used their savings and 15% borrowed funds from their investments or retirement savings. Furthermore, 71% of the parents gifted them the funds, while 61% supported them with the mortgage loan.

The key aspect to consider is that these people are true believes in the value of homeownership. According to the report published by OREA 92% believe that it is their duty to ensure that the younger generation is able to capitalise on the opportunity of owning as the older generations have done in the past. The CEO of OREA, Tim Hudak, said “We are in a housing affordability crisis being driven by severe lack of supply, and increased demand, especially around ‘missing middle’ type properties”.

Tim Hudak further highlighted that parents are becoming increasingly concerned that their children would not be able to fulfil their dreams of owning a home. Moreover, a sum of $40,878 was loaned to children by parents, while $73,605 was gifted by parents. 90% of the surveyed people also shed light on the fact that the current housing market makes it difficult for them and their children to afford houses.

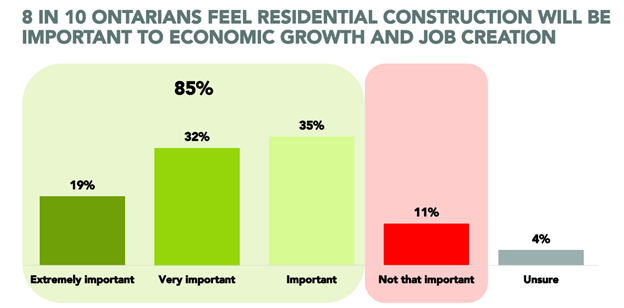

Considering the current housing market in Canada, the average pricing of homes has skyrocketed in various regions, especially Toronto and Vancouver, making it difficult for the younger generation to afford houses in these areas. To fulfil such high housing demands, the Ontario Government’s Housing Affordability Task Force has recommended that the province aim to develop 1.5 million houses within the next decade. This would increase the population density in urban and suburban areas allowing accommodation for those citizens.

There several other methods through which parents can ensure that they children can afford homes and have a home of their own. One of the common methods would be to sell the current house owned by parents to their = children. This can be done by selling the house to their children at fair market value. Parents can also loan money to their children for the purchase of their current home, however, they must ensure to charge interest. This would also require that the parents declare the interest received as income. Moreover, with the assistance of a reputable accountant, the loan can be structured in such a way which would provide low interest rate to their children.

Another method that parents can adopt is to gift their current property to their children. But they must establish an irrevocable trust so that their children can be protected against potential creditors. Dan Sullivan, a wealth strategies consultant with the Royal Bank of Canada, advised parents to transfer the ownership of properties to their children at the time of their death.

Analysts explain that current housing market conditions do not allow first time buyers to come up with the initial down payment required for the purchase of a house. Based on the current market conditions, the minimum sum of down payment required by first-time buyers is just short of $50,000 with the addition land transfer taxes and other closing costs as well. Many purchasers who are saving their income for the purchase of a house, are constantly pushed out because the prices continue to rise. To purchase a house in Canada’s 10 largest urban areas, an average of six years is required to save an amount that is needed for the down payment of a home.

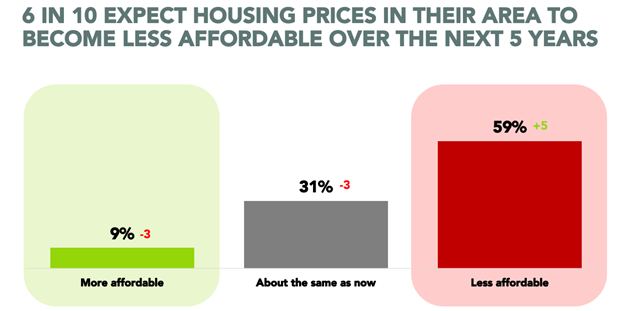

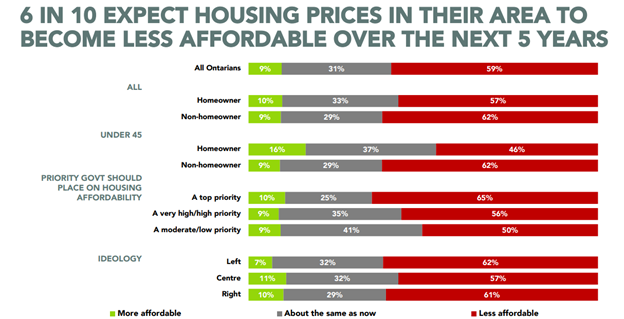

Moreover, according to OREA’s findings 77% of Ontarians have the notion that purchasing a property has become more difficult as compared to the previous year. 59% of the respondents also share that over the next five years, houses will become eve more unaffordable. This has created a ‘fear of missing out’ environment, which resulted in a surge in the demand for houses.