According to a mortgage industry report, most Canadians are not looking forward to purchasing a home considering the current housing marketing condition. A Semi-Annual State of The Mortgage Market report published by Mortgage Pros Canada (MPC) revealed an important data point in their survey which indicates that many Canadians say it is a bad time to buy a house. Moreover, the report also indicated that whether Canadians were homeowners, Boomers, renters, or first-time buyers – most agreed that it was a bad time to buy a home.

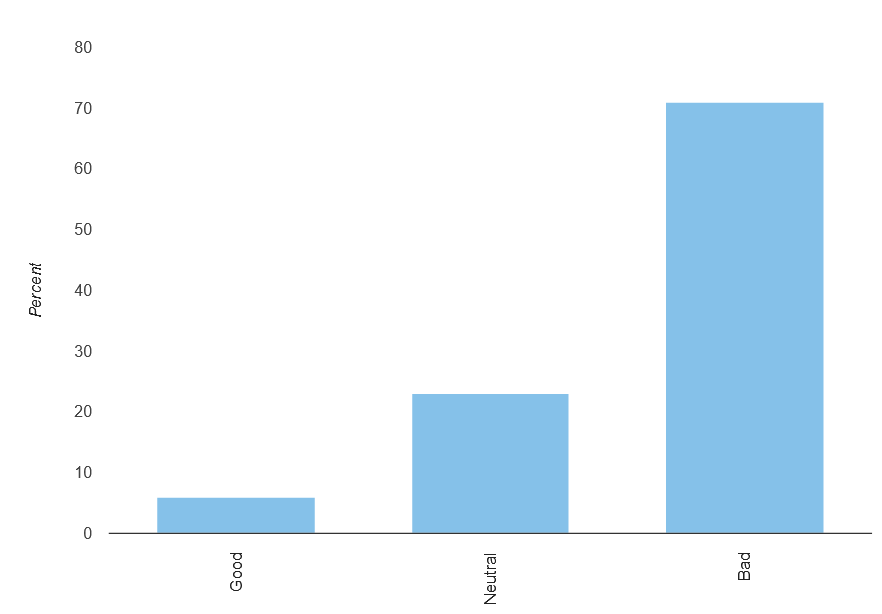

In accordance with the agency’s survey, 71% of the Canadians perceived that the current housing market situation depicts a bad time to buy a house, while 23% of the respondents felt neutral about the situation, and 6% said that it was a perfect opportunity to buy a home. Furthermore, 67% of current homeowners also revealed that they would not purchase a home considering the current market conditions, while 79% of non-owners revealed the same as well. Only 7% said that it was a good time to buy, and the remainder were neutral. Moreover, this trend was noted across all provinces of Canada.

One of the reasons why Canadians perceive it is a bad time to buy a home is attributed to the rising house prices as 82% revealed that house prices will increase next year as well. Of those respondents, 26% said that the house prices would rise dramatically, 17% expect that house prices will fall, and just 1% said that house prices will decrease in a dramatic manner.

In addition, a group representing Canada’s mortgage industry highlighted that the government has failed to address the housing shortage in the country as well the as affordability problem. A series of recommendations were also made which would assist first-time home-buyers to in purchasing their first home. MPC requested an increase to the cut-off for insurable mortgage to $1.25 million from $1 million and to bind this level to inflation in order to control the rising prices. This move would potentially allow mortgage borrowers to qualify for insurance and would also not require a full 20% down payment.

MPC also aims to provide access to first-time home-buyers for mortgage terms of up to 30 years for insured mortgages and has recommended to make mortgage qualification stress test consistent for both insured and un-insured mortgages. This can be done by setting the stress test level to two percentage points above the contract rate. Joe Pinheiro, chair of MPC, said, “To our first point, increasing the mortgage insurance cap to $1.25 million and including it on an ongoing basis was sensible enough to be an election promise made by both the current government and the Opposition last year,”.

The First-Time Home Buyers Incentive Program that was launched in September 2019 was also criticized by the organization revealing that the program is slowly moving towards failure as it offers shared equity of 5% towards the down payment of an existing resale home, or 10% for a newly constructed home. One of the reasons why the program is failing is because of added legal costs during the closing of a transaction and the qualifying criteria is too restrictive for most first-time home-buyers.