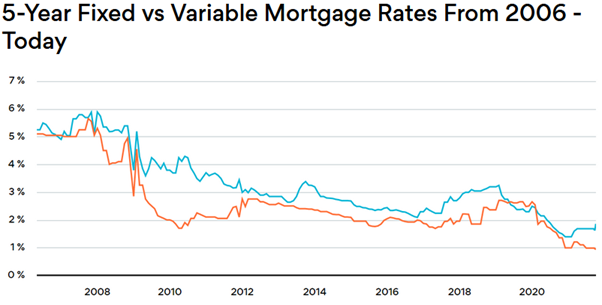

When applying for a mortgage, it is important to note that there are two types of mortgages, fixed-rate mortgages and variable or adjustable-rate mortgages (ARMs). Although mortgage companies offer both types of mortgages, it is essential to determine the type of loan that best suits your needs.

What is Fixed-Rate Mortgage?

In a fixed-rate mortgage, the lender determines a fixed rate of interest that will remain unchanged until the end of the mortgage term, usually 5 years. An important point to note is that the amount of principal and the interest paid each month differs from each monthly payment, however, the overall payment amount remain the same. This eases the process of budgeting for homeowners.

When opting for a five-year mortgage contract and having a longer amortization period, you may pay more in interest because of the extended amortization period. This is because the interest is calculated based on the amount that is remaining. When renewing your mortgage, the interest rate may be lower or higher than your current interest rate.

Advantages of Fixed-Rate Mortgage

- Borrower is protected from fluctuating monthly mortgage payments if interest rates rise.

- Fixed-rate mortgages are easily understandable.

- Fixed-rate mortgage have little variation from lender to lender.

- By fixing interest rate for two to five years, you can save a significant amount of money

An additional benefit of a fixed-rate mortgage is that you will know when you will pay off your mortgage. It will also provide confidence for making monthly budgets and ensuring that each month, your mortgage payment is paid on time. However, it is also imperative to consider that the initial interest rate is usually higher than variable-rate mortgage. The borrower is also locked into the determined interest for the duration of the mortgage term. On the account of breaking a fixed-rate mortgage, the penalties incurred are much higher than variable-rate mortgage.

Variable Rate Mortgage

The interest rate calculated on a variable rate mortgage is adjustable. Variable rate mortgages are also known as adjustable-rate mortgages. Initially, the interest rate set for variable mortgages is lower than the market rate. An important aspect to note is that if a variable rate mortgage is held for longer duration, the interest rate may surpass the market rate for fixed-rate loans.

In variable rate mortgages, there is a fixed period where the initial interest rate remains constant. At the conclusion of this period, the interest rate is adjusted at a pre-arranged frequency. The fixed-rate period can differ significantly – ranging from one month to a couple years. After the initial term ends, the loan is reset and is calculated based on the market interest rate.

Applying for a variable rate mortgage can be complicated as compared to fixed-rate mortgages. So, it is essential to explore the pros and cons of such mortgages. Advantages of having a variable rate mortgage are as follows:

- Variable rate mortgage is significantly cheaper than fixed-rate mortgages.

- Variable rate mortgages have low initial payments.

- Borrowers can save several hundred dollars per month for up to five years, after which their costs are likely to increase.

- With a variable rate mortgage, extra payments can also be made towards monthly payment resulting in paying off the mortgage sooner.

Some other benefits of a variable rate mortgage is that the initial mortgage rate is usually lower than the fixed-rate mortgage. Furthermore, if the prime rate decrease, the interest rate also decreases accordingly and more of the payments are processed towards the principal paid. Variable-rate mortgages can be converted to fixed-rate mortgages at any given time. However, an important factor to note is that if the prime rate increases, the interest rate will also increase accordingly. This results in less amount of payment processed towards the principal and increases the amortization period as well.